Which Bonds Will Do Best With Rising Interest Rates

Inflation on the rise should investors be concerned. Fine-tune fixed income portfolios with strategies that can help now.

How Do Interest Rates Affect Bonds Relationship Between Rates Bond Prices And Yields

This surprised a few bond analysts on Wall Street this.

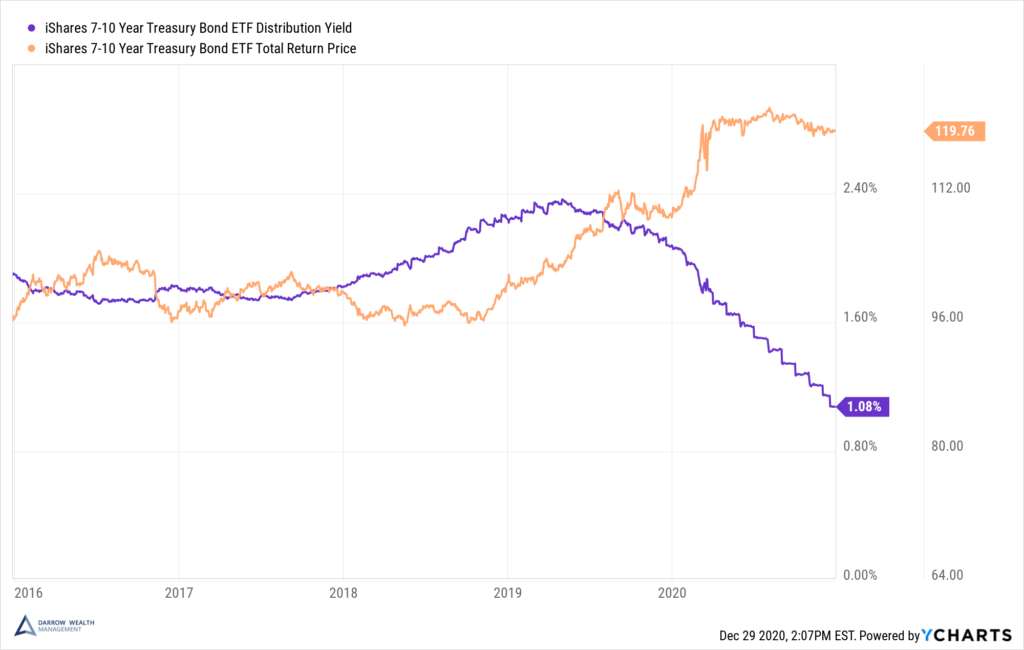

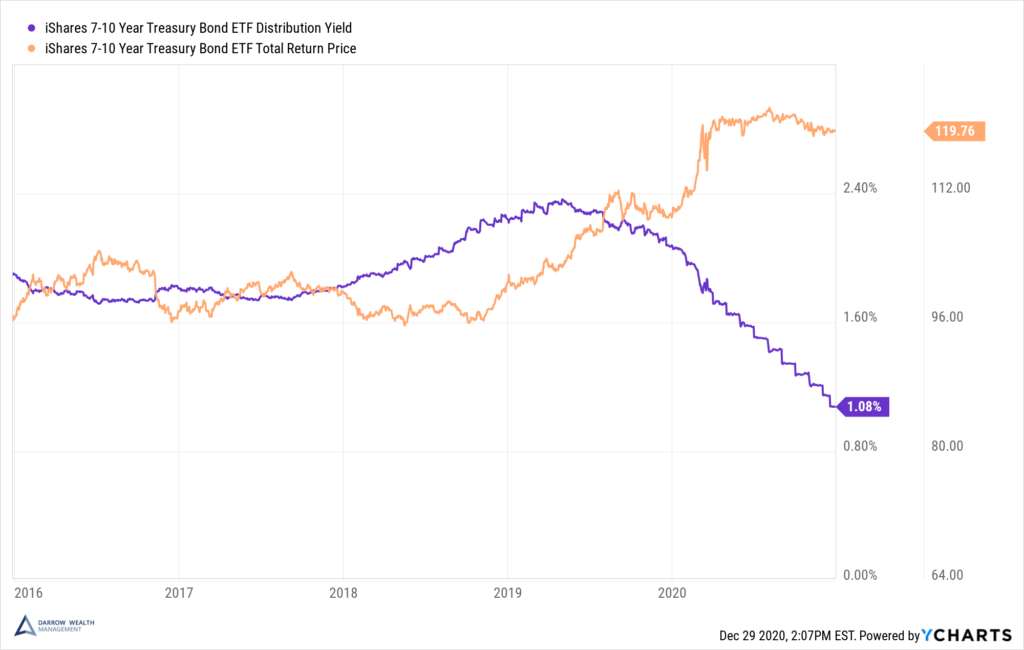

. They are going to be less risky in a rising rate. Very long-term bonds such as 10 years or longer are the most impacted by rising rates. A floating-rate note FRN is a bond with a variable interest rate that allows investors to benefit from rising interest rates.

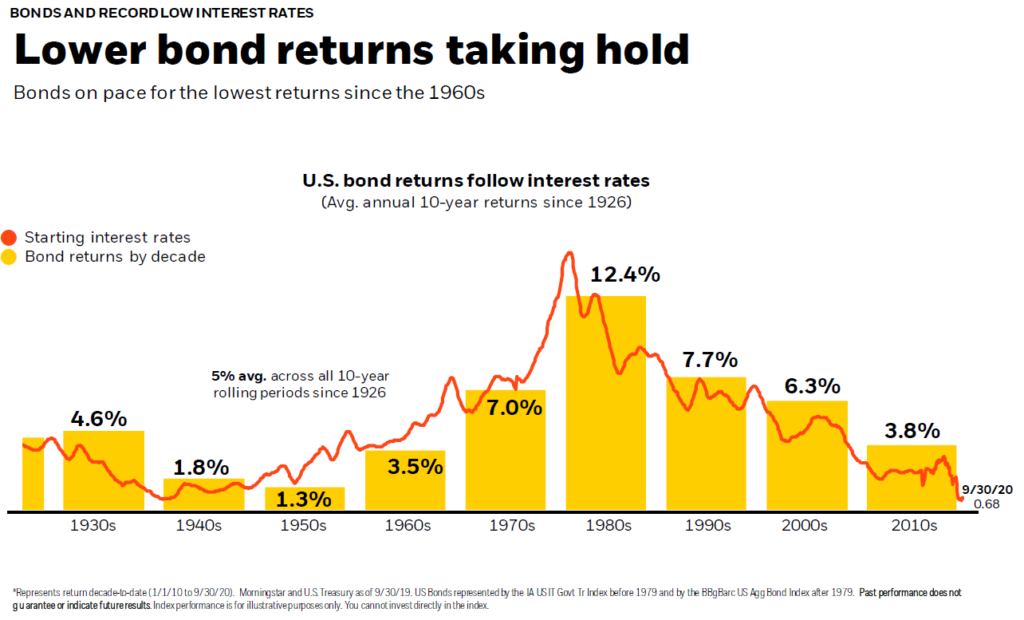

Experts recommend that investors steer clear of very long maturities until rates move up. Interest rates are rising in 2022 here are your best money moves. As rates rise bond prices drop especially on long-term bonds.

Learn the value of municipal bonds in a free guide from Fisher Investments. If market interest rates rise to. If youre primarily concerned with the risk of rising interest rates the Vanguard Short-Term Corporate Bond ETF VCSH 8197 is worth a look.

Ad Learn About The Tax-Exempt Bond Fund of America. Within the bond portion of a retirement savings portfolio she recommends 70 be in US investment grade bonds 10 in high yield 10 in international and 10 in emerging. Says one market veteran.

For example lets say you have a 10-year 1000 bond paying a 3 coupon. Prepare Your Portfolio for Rising Rates. When trying to understand the effects of.

Rising interest rates are a bad thing in the short run for most bond funds so you might. Funds database what you see is that the median return on a year-to-date basis among those funds is minus. Thats because this fund is.

I Bonds purchased now will count as May purchases and immediately get the 962 rate. Rising interest rates make prices of bonds go down. Purchases no longer gets the 712 962.

Here are some specific bond fund types that can do better than others when rates are rising. Ad The Investing Experience Youve Been Waiting for. If you look at the 535 bond ETFs that exist in Morningstars US.

Assets with the most positive sensitivity to LTB changes are in orange they will go down in price if interest rates rise just like bonds. If you are going to have bonds in your portfolio we recommend short-term bond funds until interest rates go up Milan said. Ad Investors Should Consider Using the Barbell Strategy and Adding Exposure to Commodities.

Ad Download this must-read guide about retirement income from Fisher Investments. Inflation on the rise should investors be concerned. Learn More About WisdomTrees Approach.

High-yield bonds floating-rate corporates and new muni issues look better than the fixed-income alternatives. Fine-tune fixed income portfolios with strategies that can help now. Morgan Chase Chief Executive Officer Jamie Dimon says we can expect 6 or 7 interest rate increases this year.

Ninja Update 42922. Your Guide to Munis Is Here. The value of Treasury Inflation-Protected Securities TIPS adjusts according to the level of the Consumer Price Index which provides an added level of protection against.

That is why many investors will rush to buy short- or intermediate-term bonds expecting that rates may continue. Pursue Your Goals Today. According to Rotblut the associations asset allocation models use short-term bonds and intermediate-term bonds both of which less sensitive to changes in rates than long.

I would rather take on a degree of credit risk than. A fast-growing economy paired with surging inflation have spurred the Fed into action.

Understanding Interest Rate Risk And How You Can Manage It American Century Investments

How Do Interest Rates Affect Bonds Relationship Between Rates Bond Prices And Yields

Rising Interest Rates 101 Interest Rates Investing Strategy Interesting Things

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

0 Response to "Which Bonds Will Do Best With Rising Interest Rates"

Post a Comment